Межпальцевый иск OPPO, патентный риск производителей мобильных телефонов становятся все более и более серьезно!

Dec 27,2021

Согласно недавнему объявлению InterDigital, операционной компания на патенте США, 20 декабря и 22 декабря, компания инициировала нарушение патентных прав иски против OPPO, OnePlus и Realme в Соединенном Королевстве, Индии и Германии. Патенты, вовлеченные включают 3G, 4G, 5G и для патентов, связанных со стандартом HEVC, запреты необходимы во всех судебных процессах. Это также после Xiaomi, межпальцевых еще раз инициировала иск против китайских мобильных телефонов компании в течение последних двух лет.В августе этого года, межпальцевых объявил соглашение с Xiaomi. финансовый отчет встречно-штыревые показал, что лицензирование плата Xiaomi к InterDigital достиг $ 45 млн долларов США в третьем квартале 2021 года только. патент встречно-штыревой по лицензированию стратегии всегда был относительно силен, и он также использовал методы, чтобы заставить судебные мобильные телефоны компании принять свои патентные пошлины. С 2007 года компания имеет тяжбы с производителями отрасли, такими как ZTE, Huawei, Apple, Lenovo, Samsung и Xiaomi. Среди вышеупомянутых компаний, за исключением Lenovo и которые до сих пор в судебном процессе, все другие компании подписали лицензионное соглашение с ними, а ежегодный лицензионный сбор превышает десятки миллионов долларов без исключения.

Для OPPO, можно сказать, что была волна беспорядков и другой волны. В то время как «сила атаки» от Nokia не остановилась, она столкнется с встречно-штыревые, сильный враг, который также отражает все более серьезные патентные риски, с которыми сталкиваются отечественные производители мобильных телефонов в процессе интернационализации. ситуация. Даже если патент сила OPPO в отечественной мобильной телефонной компании уже существует как «лучший ученик» и имеет команду интеллектуальной собственности с сильными профессиональными возможностями, это, очевидно, не так легко пройти этот патент «проход».

После Xiaomi, встречно-штыревые «Цели и задачи» OPPO

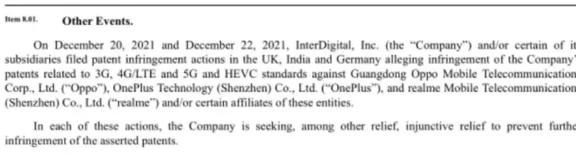

Фото:. Межпальцевые v OPPO Объявление

В настоящее время нет никаких дополнительных подробностей о v. OPPO случае встречно-штыревые, но от объявления InterDigital всего за несколько строк, этот патент иск против OPPO является крупномасштабной глобальной иск.

С точки зрения времени обвинения, межпальцевых успешно использовал судебный процесс, чтобы заставить Xiaomi осесть и воспользовался полным ответом OPPO к возможности Nokia, чтобы начать судебный процесс. Времени был только правильным. С точки зрения выбора патента, является ли он 3G, 4G, 5G и другие беспроводные технологии связи или HEVC видео кодирования и декодирования технологий, они являются технологиями, которые не могут быть обойдены с помощью смарт-телефонов в настоящее время и в течение длительного времени, чтобы прибыть. С точки зрения выбора места проведения судебного разбирательства, Соединенное Королевство является первой страной в мире, чтобы объявить юрисдикции в глобальной ставке патент лицензирования стандартного существенным. . После Wireless Planet v Huawei, также считается, что юрисдикция способствует патентообладателей; Германия традиционно запатентованы. Юрисдикция, где судебные процессы часто и, как правило, патентообладатель; Индия также является рынок смартфонов и активной юрисдикции, которая постепенно возникла в последние годы. Выбор мест для этих судебных процессов, также ожидается.

Ситуация, с которыми сталкиваются OPPO на этот раз очень похож на недавно завершившейся-штыревые против Xiaomi случае. В конце июля 2020 года, межпальцевый инициировал нарушение патентных прав иска против Xiaomi в Индии и применяются для судебного запрета. В то время китайско-индийские отношения были затяжке, и Индия была крупнейшим зарубежным рынком для Xiaomi мобильных телефонов. Выбор встречно-штыревые о времени и месте проведения судебного преследования был весьма интригующим. Межпальцевых подал в суд Xiaomi использовать те же патенты, относящиеся к беспроводной связи и стандарту HEVC. После индийского обвинения, межпальцевых впоследствии также подал дополнительные судебные преследования против Xiaomi в европейских странах, таких как Германия.

В настоящее время нет никаких дополнительных подробностей о v. OPPO случае встречно-штыревые, но от объявления InterDigital всего за несколько строк, этот патент иск против OPPO является крупномасштабной глобальной иск.

С точки зрения времени обвинения, межпальцевых успешно использовал судебный процесс, чтобы заставить Xiaomi осесть и воспользовался полным ответом OPPO к возможности Nokia, чтобы начать судебный процесс. Времени был только правильным. С точки зрения выбора патента, является ли он 3G, 4G, 5G и другие беспроводные технологии связи или HEVC видео кодирования и декодирования технологий, они являются технологиями, которые не могут быть обойдены с помощью смарт-телефонов в настоящее время и в течение длительного времени, чтобы прибыть. С точки зрения выбора места проведения судебного разбирательства, Соединенное Королевство является первой страной в мире, чтобы объявить юрисдикции в глобальной ставке патент лицензирования стандартного существенным. . После Wireless Planet v Huawei, также считается, что юрисдикция способствует патентообладателей; Германия традиционно запатентованы. Юрисдикция, где судебные процессы часто и, как правило, патентообладатель; Индия также является рынок смартфонов и активной юрисдикции, которая постепенно возникла в последние годы. Выбор мест для этих судебных процессов, также ожидается.

Ситуация, с которыми сталкиваются OPPO на этот раз очень похож на недавно завершившейся-штыревые против Xiaomi случае. В конце июля 2020 года, межпальцевый инициировал нарушение патентных прав иска против Xiaomi в Индии и применяются для судебного запрета. В то время китайско-индийские отношения были затяжке, и Индия была крупнейшим зарубежным рынком для Xiaomi мобильных телефонов. Выбор встречно-штыревые о времени и месте проведения судебного преследования был весьма интригующим. Межпальцевых подал в суд Xiaomi использовать те же патенты, относящиеся к беспроводной связи и стандарту HEVC. После индийского обвинения, межпальцевых впоследствии также подал дополнительные судебные преследования против Xiaomi в европейских странах, таких как Германия.

В то время jiwei.com предсказал, что иск с междейтальным в отношении Сяоми был только началом вопроса. Согласно статистике, доходы от междейлата резко сократились в 2018 и 2019 годах. Конечно, существует соглашение о Huawei, которое истекает, что вновь связано с участием междейтала в переговоры. Однако, даже если он присоединяется к 2020 году Huawei в 2020 году более чем 30 миллионами долларов США в патентных сборов в компании, его годовой доход ниже 350 миллионов долларов США. Минимальный уровень дохода компании. Согласно иностранному СМИ, новая эпидемия короны за последние два года также вызвала определенное негативное влияние на зарубежное дело патентных операционных компаний. Следовательно, междейтал должен «открыть» новые клиенты, основанные на изменениях в структуре рынка, с компаниями для мобильных телефонов, таких как Xiaomi и OPPO, первыми, кто нести основной удар.

Обиды между междейтальными и китайскими компаниями

InterDigital - это перечисленная компания, которая опирается на патентные сборы за его существование. Все НИОКР инвестиции конвертируются в патенты, а затем патенты используются для сбора лицензий на лицензию от производителей терминалов. Эта бизнес-модель определяет, что он должен достичь лицензионного соглашения с как можно более многими производителями терминалов с условиями лицензий, которые являются максимально полезными для себя. Предполагаемо, что межступно практически невозможно достичь этой цели, чисто ведущие переговоры. Таким образом, использование судебных разбирательств для содействия переговорам стало фиксированной бизнес-процедурой компании. Трудно договориться о договоренности о лицензированных сборах и условиях OPPO на этот раз.

Согласно предыдущей статистике Jiwei, за последние десять лет InterDital имеет пять клиентов, чья выручка составила более 10% (включительно) более двух лет подряд. Они Apple, Samsung, LG, Huawei и Pegatron. Один раз в суде с междейтальным. За исключением судебного процесса против Apple, который оказался только в финансовом отчете междиитала, и был неясен, остальные судебные процессы вызвали большее влияние.

И эта судебная стратегия действительно принесла много доходов для междейтала. Принимая Samsung в качестве примера, с 2018 года по 2020 годы, патентные сборы, которые Samsung выплачивали в междейлую, составляли 76,85 млн. Долларов США, 79,73 млн. Долларов США и 78,98 млн. Долларов США. Долларов и 78,98 млн. Долларов США.

В последние годы, с ростом китайских производителей терминала, иски междейтальных исков против китайских производителей стали чаще. В 2011 году Intermitital подал иск о патентном нарушении против Huawei и ZTE в суде Делавэр и подал 337 расследование с торговой комиссией США (ITC). В том же году Huawei подал в суд междигатальные и другие компании, чтобы злоупотреблять своей доминирующей позицией на рынке в Шэньчжэне промежуточным народным судом. С тех пор междейтал сражался с Huawei и ZTE в течение многих лет. В 2020 году междейтал последовательно достигли глобального патентного лицензионного соглашения с ZTE и Huawei и урегулировал все взаимные иски. Согласно общественной информации, лицензионное соглашение действует до 2023 года. В течение этого периода продукты Huawei и ZTe's 3G, 4G и 5G будут платить междействующие роялти.

Стоит отметить, что в сентябре 2013 года Национальная комиссия по развитию и реформированию инициировала антимонопольное расследование по междейтальному, а в марте следующего года междейтальные представили заявку на приостановку расследования, что содержало приверженность разрешению неограниченным Мобильный стандартный важный патентный портфель для китайских производителей мобильных терминалов. 22 мая этого года Национальная комиссия по развитию и реформу приостановило расследование. Эта пятилетняя приверженность позволила межгитально приостановить свое наступление против китайских производителей. Тем не менее, в августе 2019 года это приверженность истекло с истечением менее 3 месяцев, междигент не может дождаться, чтобы инициировать судебные процессы против Леново в Соединенном Королевстве и Соединенных Штатах. В июле следующего года он взял еще один выстрел против Сяоми. Теперь урегулировано глобальное лицензионное соглашение с Сяоми. Хотя судебный процесс с Lenovo все еще прогрессирует, общая тенденция судебного разбирательства также более благоприятна для междейтала. Если ничего другого, две стороны также закончится в поселении.

В то же время вклад китайских производителей на производительность междиитала также существенно увеличился. Согласно его финансовому отчету, междейтальный получил более 14 миллионов долларов США в лицензионных сборах от ZTE в 2019 году. Хотя он не был раскрыт в 2020 году, объем лицензионных сборов не должен сильно измениться; В 2020 году компания собирает более 30 миллионов долларов США в лицензионных сборах от Huawei. В двух кварталах Huawei платил более 20 миллионов долларов США в лицензионных сборах. В 2021 году междейтал успешно включал в себя Сяоми в качестве своих клиентов и собрал 45 миллионов долларов США в патентные сборы в третьем квартале.

Судя по выплате небольшого числа крупных клиентов, раскрытых в финансовом отчете междиитала, доход компании от китайских компаний удвоились за последние два года. Предполагается, что, поскольку больше китайских производителей становятся мишенями атаки междиитала, эта доля будет продолжать быстро расти.

Повышенный риск права интеллектуальной собственности производителей мобильных телефонов

В последние годы были частые глобальные патентные иски против китайских производителей мобильных телефонов. Производители мобильных телефонов, представленные Huawei, Xiaomi, и OPPO, неоднократно пострадали от патентных атак из зарубежных патентовых запасов. Среди них случаи, которые привлекли больше внимания в отрасли, включают междейтальную и Huawei, ненужной планету и Huawei, Ericsson и Xiaomi, Nokia и OPPO.

Jiwei.com считает, что риски интеллектуальной собственности китайских производителей мобильных телефонов станут все более серьезными в будущем. Причины следующие:

Прежде всего, самая важная причина заключается в том, что доля интернационализации и рынка производителей китайских мобильных телефонов становится выше и выше, и все больше и больше зарубежных рынков «заняты». Риски интеллектуальной собственности - какие компании мобильные телефоны должны преодолеть их глобальное расширение. Уровни и проблемы решены «сладкие неприятности».

Во-вторых, как технология связи для мобильных телефонов развиваются с 4G до 5 г, патентных «аппетит» для зарядки патентных сборов также увеличивается. Связанное лицо из более чем одной компании мобильной связи сообщила Jiwei, что соотношение распределения существенных патентов на стандарты 4G на 5 г более децентрализовано, что означает, что больше компаний и патентных компаний взимают взимание мобильных телефонов для патентных сборов, а также необходимые ставки намного выше 4 г. Коммерческое использование технологии 5G все еще находится в асцендентке, а высокие патентные сборы уже вызвали компании мобильных телефонов. Мы «перегружены».

Наконец, существует влияние глобальной эпидемии за последние два года. Прибытие эпидемии сделало жизнь более сложнее для некоторых патентных операционных компаний без физических продуктов. Согласно иностранным средствам массовой информации, новая эпидемия короны вызвала определенное негативное влияние на обвинительный бизнес патентных операционных компаний, которые также стимулировали такие компании, как междейтальные, чтобы стать все более агрессивными в своем выборе судебных разбирательств.

OPPO: уважайте права интеллектуальной собственности, но выступают против чрезмерных сборов

С точки зрения OPPO, тяжесть ситуации может быть беспрецедентной. С июля этого года Nokia инициировала огромный патентный иск против OPPO в Великобритании, Франции, Индии и других странах и регионах. Хотя OPPO сделал прекрасный ответ, он не только делал регулярные ответы, но и встретивно изложил Nokia с патентами базовой станции 5G во многих странах и регионах, но нелегко бороться с Nokia. Патентное накопление Nokia от эпохи 2G до сегодняшнего дня, а также прошлых «записей Nokia», достаточно, чтобы показать свою силу. Перед OPPO в мире было очень мало производителей терминалов, которые имели возможность встретить против него.

Немедленный враг еще не был решен, а атака междейлата снова прибыла. Согласно данным, команда междейтала, ведущая в патентное лицензирование и судебный процесс, имеет много лицензионных ветеранов, которые работали на Qualcomm, Nokia и других компаний. Они радикальные, сильные и опытные, и их сила не должна быть недооценена. Как упоминалось ранее, эта история судебных органов НПЭ может почти охватить изменения на мировом рынке мобильных телефонов. Опираясь на судебное разбирательство для содействия переговорам, InterDigital повернул Apple, Samsung, Huawei, Xiaomi, LG, ZTE и других производителей в своих собственных клиентах. Отказ Его сила в области патентного судебного разбирательства также на бумаге.

Столкнувшись с серьезными рисками интеллектуальной собственности, OPPO явно выдвинул свои претензии на интеллектуальную собственность. Фэн Ин, старший директор отдела его интеллектуальной собственности, неоднократно заявлял: «OPPO уважает права интеллектуальной собственности и защищает разумные сборы и выступает за урегулирование лицензиоров и лицензиатов через дружеские консультации. Споры между людьми, взаимное уважение к ценности патентов. , С другой стороны, OPPO крепко выступает против чрезмерных патентных сборов, решительно выступает против применения судебных разбирательств для того, чтобы принять переговоры и принимают чрезмерно высокие лицензионные сборы и выступают за создание экологии здоровой интеллектуальной собственности ».

Уважение прав интеллектуальной собственности является последовательное отношение OPPO, и это должно быть консенсус всех технологических производителей. В то же время уважая права интеллектуальной собственности не означает принятия и спрашивания, а решительно противоположное злоупотребление судебным разбирательством и чрезмерно высокими сборы заключаются в том, чтобы защитить свои коммерческие интересы и защитить порядок всей отрасли. Это еще более непоколебимо, когда повышаются риски.

Конечно, OPPO делал это долгое время, и это утверждение интеллектуальной собственности не изменится в будущем. За прошедший промежуток времени команда интеллектуальной собственности OPPO успешно разрешила патентные споры с компаниями, такими как острые, и достигли лицензионных соглашений и даже перекрестных лицензионных соглашений со многими патентунами, такими как Sharp, NTT DOCOMO и Sisvel. Кроме того, OPPO почти достиг благоприятных результатов в предыдущем глобальном судебном разбирательстве. Среди них Siemens подал заявку на патент OPPO в Китае за недействительство; Испанская патентная компания Fractus v. Дело ОпПо было отклонено после того, как патент, участвующий в судебном процессе, был недействительным; Острый чехол в Китае большое количество членов китайских семей, участвующих в патентных судебных разбирательствах, были признаны недействительными, и впоследствии острые вынуждены поселиться с OPPO; Итальянская патентная операционная компания Sisvel вернулась после начала конфронтации с OPPO в Нидерландах. Эта серия достижений показывает, что команда интеллектуальной собственности OPPO имеет возможность спокойно иметь дело с патентным судебным разбирательством во всем мире. Поэтому, хотя риски и проблемы прав интеллектуальной собственности являются беспрепарациональными, основанные на его предыдущей записи, я считаю, что команда интеллектуальной собственности OPPO может правильно обрабатывать их.

Обиды между междейтальными и китайскими компаниями

InterDigital - это перечисленная компания, которая опирается на патентные сборы за его существование. Все НИОКР инвестиции конвертируются в патенты, а затем патенты используются для сбора лицензий на лицензию от производителей терминалов. Эта бизнес-модель определяет, что он должен достичь лицензионного соглашения с как можно более многими производителями терминалов с условиями лицензий, которые являются максимально полезными для себя. Предполагаемо, что межступно практически невозможно достичь этой цели, чисто ведущие переговоры. Таким образом, использование судебных разбирательств для содействия переговорам стало фиксированной бизнес-процедурой компании. Трудно договориться о договоренности о лицензированных сборах и условиях OPPO на этот раз.

Согласно предыдущей статистике Jiwei, за последние десять лет InterDital имеет пять клиентов, чья выручка составила более 10% (включительно) более двух лет подряд. Они Apple, Samsung, LG, Huawei и Pegatron. Один раз в суде с междейтальным. За исключением судебного процесса против Apple, который оказался только в финансовом отчете междиитала, и был неясен, остальные судебные процессы вызвали большее влияние.

И эта судебная стратегия действительно принесла много доходов для междейтала. Принимая Samsung в качестве примера, с 2018 года по 2020 годы, патентные сборы, которые Samsung выплачивали в междейлую, составляли 76,85 млн. Долларов США, 79,73 млн. Долларов США и 78,98 млн. Долларов США. Долларов и 78,98 млн. Долларов США.

В последние годы, с ростом китайских производителей терминала, иски междейтальных исков против китайских производителей стали чаще. В 2011 году Intermitital подал иск о патентном нарушении против Huawei и ZTE в суде Делавэр и подал 337 расследование с торговой комиссией США (ITC). В том же году Huawei подал в суд междигатальные и другие компании, чтобы злоупотреблять своей доминирующей позицией на рынке в Шэньчжэне промежуточным народным судом. С тех пор междейтал сражался с Huawei и ZTE в течение многих лет. В 2020 году междейтал последовательно достигли глобального патентного лицензионного соглашения с ZTE и Huawei и урегулировал все взаимные иски. Согласно общественной информации, лицензионное соглашение действует до 2023 года. В течение этого периода продукты Huawei и ZTe's 3G, 4G и 5G будут платить междействующие роялти.

Стоит отметить, что в сентябре 2013 года Национальная комиссия по развитию и реформированию инициировала антимонопольное расследование по междейтальному, а в марте следующего года междейтальные представили заявку на приостановку расследования, что содержало приверженность разрешению неограниченным Мобильный стандартный важный патентный портфель для китайских производителей мобильных терминалов. 22 мая этого года Национальная комиссия по развитию и реформу приостановило расследование. Эта пятилетняя приверженность позволила межгитально приостановить свое наступление против китайских производителей. Тем не менее, в августе 2019 года это приверженность истекло с истечением менее 3 месяцев, междигент не может дождаться, чтобы инициировать судебные процессы против Леново в Соединенном Королевстве и Соединенных Штатах. В июле следующего года он взял еще один выстрел против Сяоми. Теперь урегулировано глобальное лицензионное соглашение с Сяоми. Хотя судебный процесс с Lenovo все еще прогрессирует, общая тенденция судебного разбирательства также более благоприятна для междейтала. Если ничего другого, две стороны также закончится в поселении.

В то же время вклад китайских производителей на производительность междиитала также существенно увеличился. Согласно его финансовому отчету, междейтальный получил более 14 миллионов долларов США в лицензионных сборах от ZTE в 2019 году. Хотя он не был раскрыт в 2020 году, объем лицензионных сборов не должен сильно измениться; В 2020 году компания собирает более 30 миллионов долларов США в лицензионных сборах от Huawei. В двух кварталах Huawei платил более 20 миллионов долларов США в лицензионных сборах. В 2021 году междейтал успешно включал в себя Сяоми в качестве своих клиентов и собрал 45 миллионов долларов США в патентные сборы в третьем квартале.

Судя по выплате небольшого числа крупных клиентов, раскрытых в финансовом отчете междиитала, доход компании от китайских компаний удвоились за последние два года. Предполагается, что, поскольку больше китайских производителей становятся мишенями атаки междиитала, эта доля будет продолжать быстро расти.

Повышенный риск права интеллектуальной собственности производителей мобильных телефонов

В последние годы были частые глобальные патентные иски против китайских производителей мобильных телефонов. Производители мобильных телефонов, представленные Huawei, Xiaomi, и OPPO, неоднократно пострадали от патентных атак из зарубежных патентовых запасов. Среди них случаи, которые привлекли больше внимания в отрасли, включают междейтальную и Huawei, ненужной планету и Huawei, Ericsson и Xiaomi, Nokia и OPPO.

Jiwei.com считает, что риски интеллектуальной собственности китайских производителей мобильных телефонов станут все более серьезными в будущем. Причины следующие:

Прежде всего, самая важная причина заключается в том, что доля интернационализации и рынка производителей китайских мобильных телефонов становится выше и выше, и все больше и больше зарубежных рынков «заняты». Риски интеллектуальной собственности - какие компании мобильные телефоны должны преодолеть их глобальное расширение. Уровни и проблемы решены «сладкие неприятности».

Во-вторых, как технология связи для мобильных телефонов развиваются с 4G до 5 г, патентных «аппетит» для зарядки патентных сборов также увеличивается. Связанное лицо из более чем одной компании мобильной связи сообщила Jiwei, что соотношение распределения существенных патентов на стандарты 4G на 5 г более децентрализовано, что означает, что больше компаний и патентных компаний взимают взимание мобильных телефонов для патентных сборов, а также необходимые ставки намного выше 4 г. Коммерческое использование технологии 5G все еще находится в асцендентке, а высокие патентные сборы уже вызвали компании мобильных телефонов. Мы «перегружены».

Наконец, существует влияние глобальной эпидемии за последние два года. Прибытие эпидемии сделало жизнь более сложнее для некоторых патентных операционных компаний без физических продуктов. Согласно иностранным средствам массовой информации, новая эпидемия короны вызвала определенное негативное влияние на обвинительный бизнес патентных операционных компаний, которые также стимулировали такие компании, как междейтальные, чтобы стать все более агрессивными в своем выборе судебных разбирательств.

OPPO: уважайте права интеллектуальной собственности, но выступают против чрезмерных сборов

С точки зрения OPPO, тяжесть ситуации может быть беспрецедентной. С июля этого года Nokia инициировала огромный патентный иск против OPPO в Великобритании, Франции, Индии и других странах и регионах. Хотя OPPO сделал прекрасный ответ, он не только делал регулярные ответы, но и встретивно изложил Nokia с патентами базовой станции 5G во многих странах и регионах, но нелегко бороться с Nokia. Патентное накопление Nokia от эпохи 2G до сегодняшнего дня, а также прошлых «записей Nokia», достаточно, чтобы показать свою силу. Перед OPPO в мире было очень мало производителей терминалов, которые имели возможность встретить против него.

Немедленный враг еще не был решен, а атака междейлата снова прибыла. Согласно данным, команда междейтала, ведущая в патентное лицензирование и судебный процесс, имеет много лицензионных ветеранов, которые работали на Qualcomm, Nokia и других компаний. Они радикальные, сильные и опытные, и их сила не должна быть недооценена. Как упоминалось ранее, эта история судебных органов НПЭ может почти охватить изменения на мировом рынке мобильных телефонов. Опираясь на судебное разбирательство для содействия переговорам, InterDigital повернул Apple, Samsung, Huawei, Xiaomi, LG, ZTE и других производителей в своих собственных клиентах. Отказ Его сила в области патентного судебного разбирательства также на бумаге.

Столкнувшись с серьезными рисками интеллектуальной собственности, OPPO явно выдвинул свои претензии на интеллектуальную собственность. Фэн Ин, старший директор отдела его интеллектуальной собственности, неоднократно заявлял: «OPPO уважает права интеллектуальной собственности и защищает разумные сборы и выступает за урегулирование лицензиоров и лицензиатов через дружеские консультации. Споры между людьми, взаимное уважение к ценности патентов. , С другой стороны, OPPO крепко выступает против чрезмерных патентных сборов, решительно выступает против применения судебных разбирательств для того, чтобы принять переговоры и принимают чрезмерно высокие лицензионные сборы и выступают за создание экологии здоровой интеллектуальной собственности ».

Уважение прав интеллектуальной собственности является последовательное отношение OPPO, и это должно быть консенсус всех технологических производителей. В то же время уважая права интеллектуальной собственности не означает принятия и спрашивания, а решительно противоположное злоупотребление судебным разбирательством и чрезмерно высокими сборы заключаются в том, чтобы защитить свои коммерческие интересы и защитить порядок всей отрасли. Это еще более непоколебимо, когда повышаются риски.

Конечно, OPPO делал это долгое время, и это утверждение интеллектуальной собственности не изменится в будущем. За прошедший промежуток времени команда интеллектуальной собственности OPPO успешно разрешила патентные споры с компаниями, такими как острые, и достигли лицензионных соглашений и даже перекрестных лицензионных соглашений со многими патентунами, такими как Sharp, NTT DOCOMO и Sisvel. Кроме того, OPPO почти достиг благоприятных результатов в предыдущем глобальном судебном разбирательстве. Среди них Siemens подал заявку на патент OPPO в Китае за недействительство; Испанская патентная компания Fractus v. Дело ОпПо было отклонено после того, как патент, участвующий в судебном процессе, был недействительным; Острый чехол в Китае большое количество членов китайских семей, участвующих в патентных судебных разбирательствах, были признаны недействительными, и впоследствии острые вынуждены поселиться с OPPO; Итальянская патентная операционная компания Sisvel вернулась после начала конфронтации с OPPO в Нидерландах. Эта серия достижений показывает, что команда интеллектуальной собственности OPPO имеет возможность спокойно иметь дело с патентным судебным разбирательством во всем мире. Поэтому, хотя риски и проблемы прав интеллектуальной собственности являются беспрепарациональными, основанные на его предыдущей записи, я считаю, что команда интеллектуальной собственности OPPO может правильно обрабатывать их.