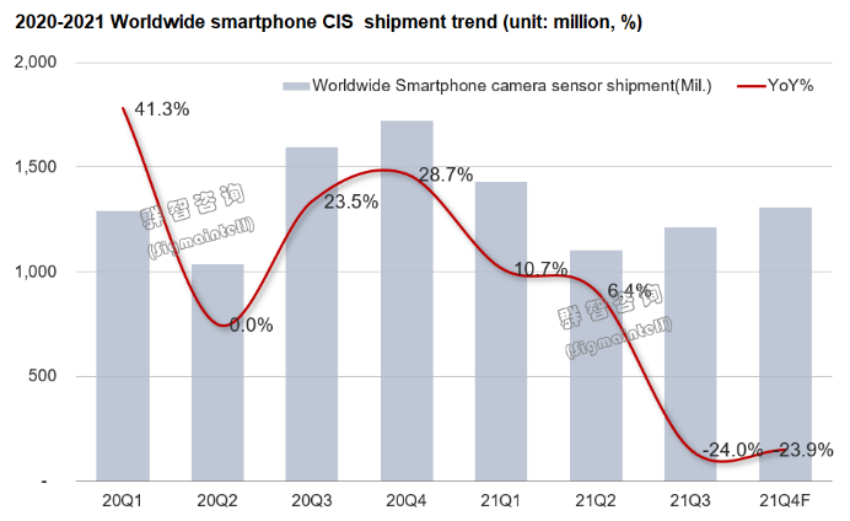

Sigmaintell: Global smartphone image sensor shipments are expected to be 5.05 billion units in 2021, a year-on-year decrease of 10.3%

Dec 04,2021

The overall performance of the camera market in the third quarter was sluggish, chip vendors' shipments were poor and component inventories continued to rise. Although the supply chain has responded quickly to market changes and adjusted market strategies in a timely manner, it still cannot drive demand up.

According to Sigmaintell survey data, global smartphone image sensor shipments in the third quarter of 2021 are approximately 1.21 billion, a year-on-year decline of approximately 24.0%. Global smartphone image sensor shipments are expected to be approximately 5.05 billion in 2021, a year-on-year decrease of 10.3 %.

According to Sigmaintell survey data, global smartphone image sensor shipments in the third quarter of 2021 are approximately 1.21 billion, a year-on-year decline of approximately 24.0%. Global smartphone image sensor shipments are expected to be approximately 5.05 billion in 2021, a year-on-year decrease of 10.3 %.

It believes that there are two main reasons: first, the demand for the entire terminal in the third quarter (except for Apple) has not improved significantly, especially in overseas markets due to the repeated epidemics, which has caused global logistics and transportation to be blocked and the capacity supply of some brands in overseas factories is limited; , Due to the early release of terminal brand demand at the beginning of the year, the supply chain actively cooperated with a large number of stocks, which caused the demand to be overdrawn in advance.

Affected by the price increase of semiconductor chips and the Huawei incident, brand manufacturers have been actively pulling in image sensor chips from the second half of 2020. The market has frequently exceeded expectations to stock up. However, terminal sales in the overall market have been in a relatively weak state, superimposing this year. The impact of the overseas epidemic in the second quarter has kept terminal inventory (complete machine and channel inventory) at a high level, which in turn affected the demand for image sensors of brand manufacturers in the third and fourth quarters, and the overall peak season was not busy.

Chen Jun, deputy general manager and chief analyst of Sigmaintell, said that based on our long-term follow-up research on the supply chain of the mobile phone market, we will see that in recent years, especially the external environment has undergone drastic changes, and the pace of changes in the entire market is very fast. For the mobile phone market next year, the biggest change is undoubtedly the return of glory.

Regarding the judgment of Honor’s fundamentals, Honor itself’s demand for image sensors, according to Sigmaintell’s data calculations, it is estimated that the demand for Honor’s image sensors in 2021 will be about 190 million, and its demand for next year will be about 400 million, showing a year-on-year Doubling trend. In today's environment where market demand is relatively stable, including brands such as Apple, Samsung, Xiaomi, OPPO, and vivo, their future incremental space is bound to be affected to a certain extent.

From the perspective of the needs of major customers, in the mobile phone market, affected by the "polarization" of the global economy, low-end demand has a trend of continuing to extend the replacement cycle, and the proportion of high-end has continued to increase. With the release of the new iPhone 13 by Apple, the price of the new phone will fall further, which will inevitably impact the mid-to-high-end layout of Andriod manufacturers. Sony is expected to be the biggest beneficiary, and its image sensor business revenue will continue to rise.

After the epidemic, under the expected impact of global hyper-inflation, the cost of the whole machine design has continued to rise. Under the situation of relatively stable product price positioning, there are mainly two solutions left to the brand, or "device reduction", or It is "terminal price increase". According to Sigmaintell's research, the current terminal brands mainly maintain or reduce the number of cameras in terms of cameras, remove the depth of field and macro of unnecessary functions, and maintain the number of cameras at about 3.8, while upgrading the functional specifications of the cameras.

Affected by the price increase of semiconductor chips and the Huawei incident, brand manufacturers have been actively pulling in image sensor chips from the second half of 2020. The market has frequently exceeded expectations to stock up. However, terminal sales in the overall market have been in a relatively weak state, superimposing this year. The impact of the overseas epidemic in the second quarter has kept terminal inventory (complete machine and channel inventory) at a high level, which in turn affected the demand for image sensors of brand manufacturers in the third and fourth quarters, and the overall peak season was not busy.

Chen Jun, deputy general manager and chief analyst of Sigmaintell, said that based on our long-term follow-up research on the supply chain of the mobile phone market, we will see that in recent years, especially the external environment has undergone drastic changes, and the pace of changes in the entire market is very fast. For the mobile phone market next year, the biggest change is undoubtedly the return of glory.

Regarding the judgment of Honor’s fundamentals, Honor itself’s demand for image sensors, according to Sigmaintell’s data calculations, it is estimated that the demand for Honor’s image sensors in 2021 will be about 190 million, and its demand for next year will be about 400 million, showing a year-on-year Doubling trend. In today's environment where market demand is relatively stable, including brands such as Apple, Samsung, Xiaomi, OPPO, and vivo, their future incremental space is bound to be affected to a certain extent.

From the perspective of the needs of major customers, in the mobile phone market, affected by the "polarization" of the global economy, low-end demand has a trend of continuing to extend the replacement cycle, and the proportion of high-end has continued to increase. With the release of the new iPhone 13 by Apple, the price of the new phone will fall further, which will inevitably impact the mid-to-high-end layout of Andriod manufacturers. Sony is expected to be the biggest beneficiary, and its image sensor business revenue will continue to rise.

After the epidemic, under the expected impact of global hyper-inflation, the cost of the whole machine design has continued to rise. Under the situation of relatively stable product price positioning, there are mainly two solutions left to the brand, or "device reduction", or It is "terminal price increase". According to Sigmaintell's research, the current terminal brands mainly maintain or reduce the number of cameras in terms of cameras, remove the depth of field and macro of unnecessary functions, and maintain the number of cameras at about 3.8, while upgrading the functional specifications of the cameras.